Effects of Car Modifications on Your Insurance Policy: A Comprehensive Guide

Discover the impact of car modifications on your insurance policy. This informative blog post explores the implications of vehicle customization, providing insights into insurance premiums, coverage limitations, and important considerations. Read on to make informed decisions about car modifications and protect your investment.

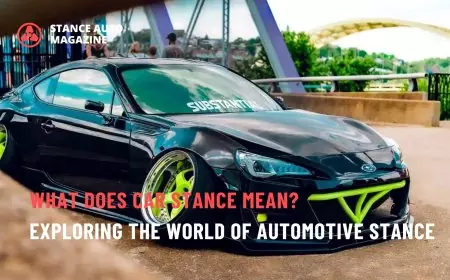

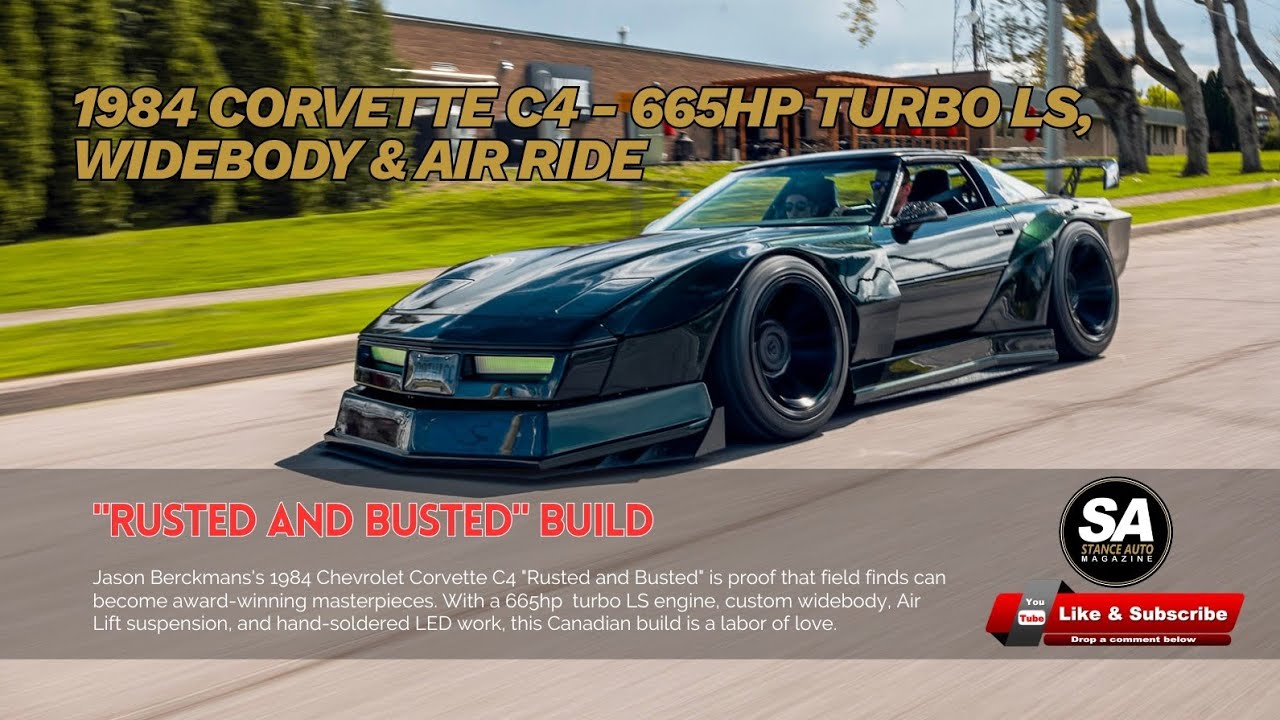

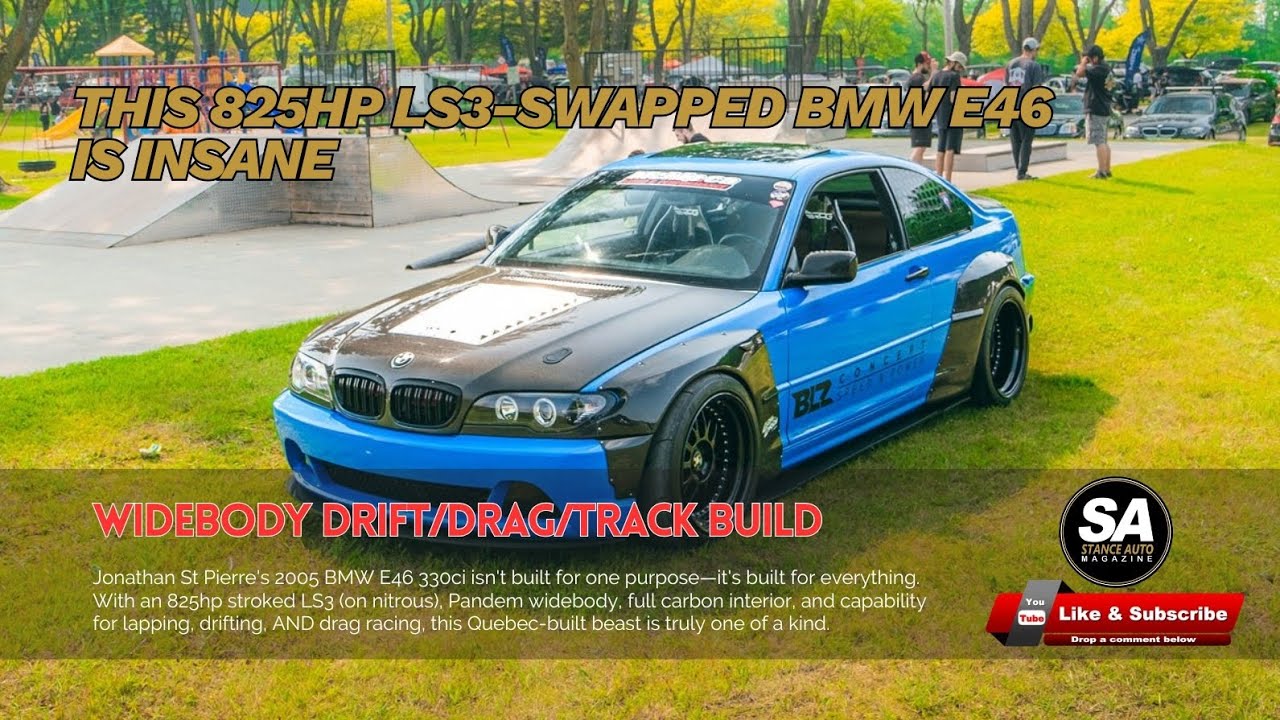

Discover the art of automotive expression with Stance Auto Magazine. "Unleash your passion for unique builds, performance upgrades, and the vibrant car culture. Stay updated with the latest news, in-depth features, and expert insights. Join our community of like-minded enthusiasts and elevate your automotive experience. Explore Stance Auto Magazine today!"

Order Your Printed Magazine Here!!

Effects of Car Modifications on Your Insurance Policy: A Comprehensive Guide

Car enthusiasts often seek to personalize their vehicles through modifications. However, it's important to understand the potential effects these modifications can have on your insurance policy. This blog post aims to shed light on the implications of car modifications, covering key considerations that can impact your insurance coverage and premiums.

Understanding Car Modifications

Car modifications refer to any alterations made to a vehicle that deviate from its original factory specifications. These modifications can range from simple cosmetic changes to extensive performance enhancements. While they allow car owners to express their individuality and enhance their driving experience, they can also introduce complexities when it comes to insurance coverage.

Impact on Insurance Premiums

Car modifications can significantly impact insurance premiums. Insurers consider modified cars to be higher risks due to their potential for increased speeds, altered handling characteristics, and higher value. These factors contribute to the likelihood of accidents and potential repair costs.

When determining insurance premiums, insurers may assess the cost of the modifications, the vehicle's new market value, and the increased risk associated with the changes. As a result, modified cars often attract higher insurance premiums compared to their stock counterparts.

Coverage Limitations and Exclusions

It's crucial to be aware that car modifications can result in coverage limitations and exclusions. Insurers may exclude coverage for specific modifications, especially those that substantially alter a vehicle's performance or safety features. For example, modifications to the engine, suspension, or exhaust systems may raise concerns regarding roadworthiness and compliance with safety regulations.

Additionally, insurers might limit coverage for costly aftermarket parts or accessories that have been installed. It's advisable to review your policy carefully or consult with your insurance provider to understand the extent of coverage for modified components.

Important Considerations

Before proceeding with car modifications, consider the following important factors:

1. Disclosure to the Insurance Company

Failing to disclose car modifications to your insurance provider can lead to serious consequences. If you fail to notify your insurer about modifications and file a claim related to those changes, the insurer may deny coverage. Always inform your insurance company about any modifications made to your vehicle to ensure adequate coverage.

2. Seek Professional Installation

When making modifications, it's essential to rely on professional installers with expertise in the specific type of modification. Poorly executed modifications can lead to safety issues and increase the likelihood of accidents. Professional installation can help maintain the integrity and safety of the vehicle while reducing the risk of complications with insurance coverage.

3. Consult with Your Insurance Provider

Engage in open communication with your insurance provider to understand their policies and guidelines regarding car modifications. They can provide valuable insights into how specific modifications may affect your coverage and premiums. Their expertise can help you make informed decisions and avoid any surprises in the event of a claim.

Conclusion

While car modifications can enhance the appearance and performance of your vehicle, it's important to consider their implications on your insurance policy. Understand that modifications can impact insurance premiums, lead to coverage limitations, and require proper disclosure to your insurance provider.

By taking these factors into account, you can make informed decisions about car modifications and ensure your investment is protected. Remember, always consult with your insurance provider for personalized advice regarding car modifications and their effects on your insurance policy.

Remember To Read These Articles:

Best Cars to Customize: Unleashing Your Automotive Creativity

What Counts as Modifying a Car? Understanding the Boundaries of Automotive Customization

Have your say, and leave a COMMENT BELOW, it helps the story get more views and reach the Printed Magazine, Thank you.

All Photographs are supplied and owned by the Photographer named, our Photographers can be found HERE!

All of our Magazines can be found on Amazon, they Print and Deliver worldwide, Stance Auto can not be held responsible for the final print, and all complaints and returns must be directed to Amazon.

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)