How can I save money on my car insurance?

Many insurers apply credit-based insurance scores to pricing models. Improving your credit over time can lead to significantly lower car insurance premium costs.

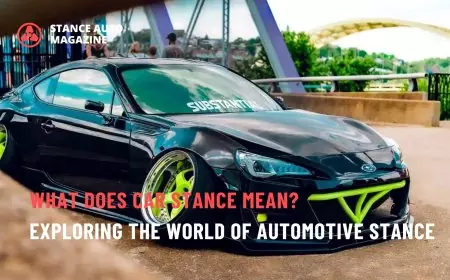

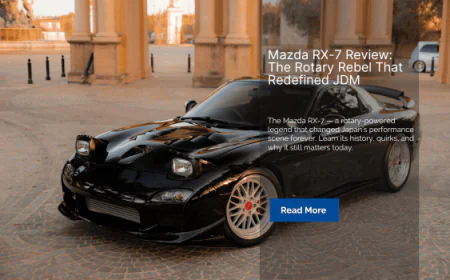

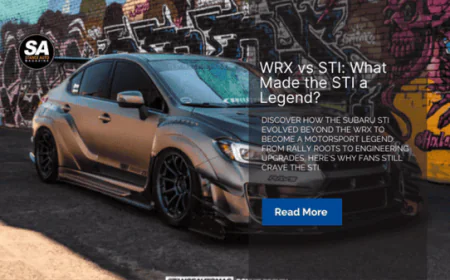

Welcome, Stay updated with the latest news, in-depth features, and expert insights. Join our community of like-minded enthusiasts and elevate your automotive experience. Explore Stance Auto Magazine today!"

>>> Submit Your Stories Here <<<

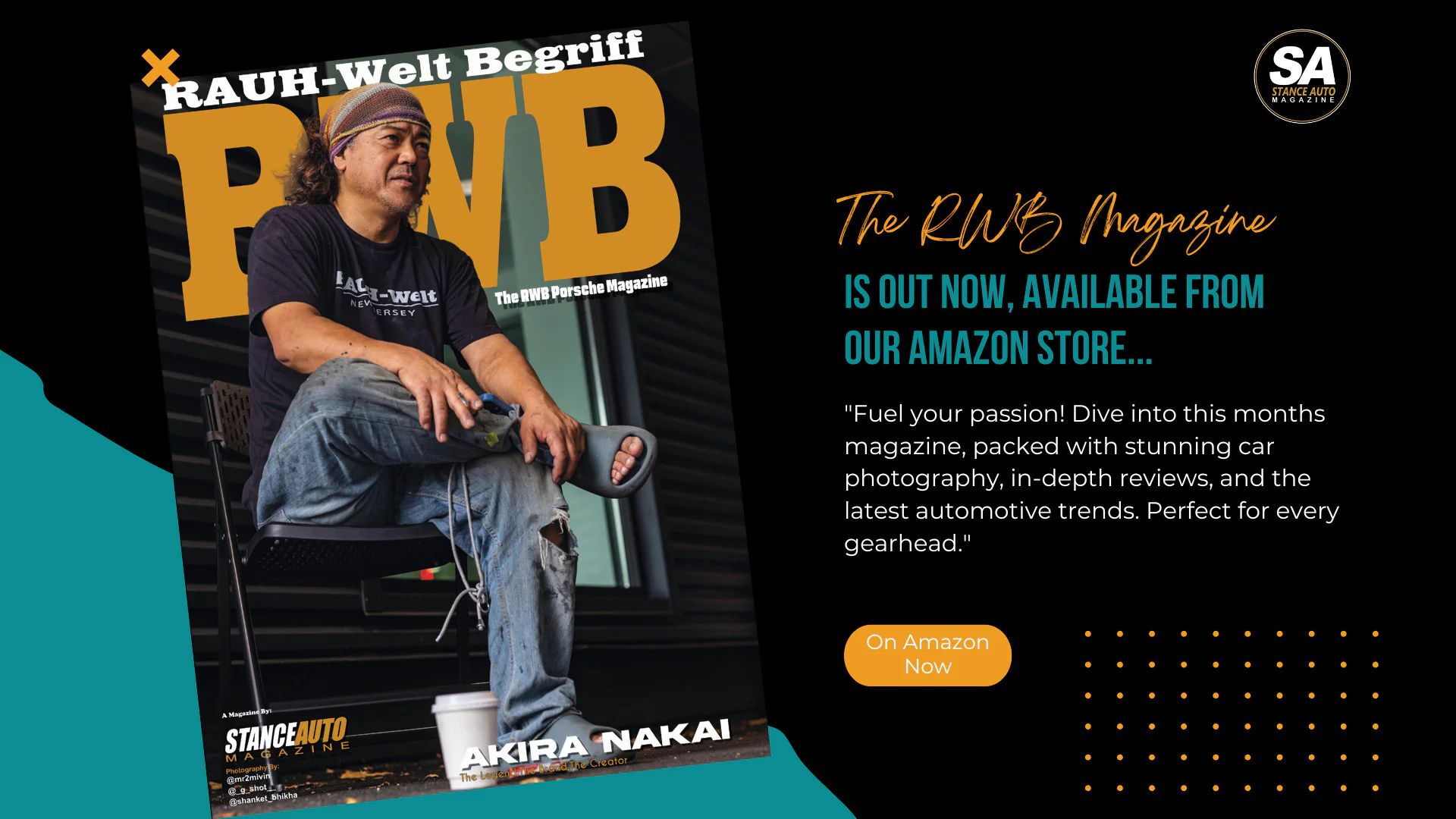

Order Your Printed Magazine Here!!

Evaluate Your Coverage to Cut Premium Costs

Purchasing car insurance represents a significant cost for most drivers. However, you may be able to reduce your premium payments substantially by taking the time to fully evaluate your coverage options. Doing so can help you identify areas where you may be overpaying without realizing it.

Start by reviewing the various components of an auto insurance policy. Most insurers segment coverage into categories like bodily injury liability, property damage liability, personal injury protection (PIP), collision, comprehensive and uninsured/underinsured motorist. Carefully analyze what each covers to determine what limits and deductibles make the most sense for your situation. Dropping certain components entirely may also produce savings, although that exposes you to more financial risk.

Compare Quotes From Multiple Providers

One of the easiest ways to save money on car insurance involves collecting and comparing rate quotes from multiple insurance carriers. Most insurers now make this simple by providing online quote tools and smartphone apps. Spend some time entering the same coverage details into various provider systems to analyze premium differences.

Focus your efforts on large, national insurance brands along with local and regional companies. Insurers utilize varying proprietary rating factors and formulas to set prices, so there can be major discrepancies between carriers. Checking several options essentially allows you to shop the market for the best deal.

Apply All Available Discounts

Insurers offer an array of discounts designed to lower premiums and attract business. Most relate to things like:

Drive Less to Lower Premium Costs

One of the biggest factors auto insurers use to set rates involves your estimated annual mileage. The more miles you drive each year, the more exposure to potential accidents and claims. Thus, companies charge higher premiums for policyholders who spend more time on the road.

If you don't drive extensive distances very often, reducing your mileage can provide significant savings. Contact your insurance provider to adjust your estimated annual mileage lower during your next policy renewal. Just be sure to accurately report your driving activity to avoid insurance fraud issues or problems at claims time.

Take a Defensive Driving Course

Many insurers provide premium discounts for completing an approved defensive driving course. These classes teach accident avoidance techniques focusing on hazard perception, risk evaluation and emergency manoeuvres. They provide motorists with safe driving knowledge and skills useful for reducing crash risk.

Defensive driving discounts generally apply to all covered drivers on a policy. Coupon codes and vouchers for online courses may enable you to enrol for free through certain insurance partners. Make sure to confirm that your insurer offers premium reductions for the specific class you complete.

Install Vehicle Telematics or Usage-Based Insurance

Usage-based auto insurance programs from carriers like Progressive, Allstate and State Farm utilize technologies that allow insurers to monitor driving performance. Policyholders install telematics devices or use smartphone apps to transmit data like vehicle speed, acceleration, cornering, braking, phone distraction and trip mileage.

Insurers then apply the data analytics to reward less risky driving with discounted premiums. Good drivers can potentially save hundreds per year, although savings vary widely based on several individual usage factors. Those uncomfortable with constant monitoring may want to consider more traditional discount options instead.

You're right, my apologies. Here are the 4 questions worked into Section 3:

Improving Credit Scores to Save on Premiums

How Much Can I Reduce Car Insurance Costs?

Drivers with the highest credit ratings often save hundreds of dollars per year on auto insurance premiums compared to those with poor credit scores. So there is massive savings potential. Most experts suggest realistically targeting a minimum 80-point insurance credit score increase over 12 months. This can reduce annual insurance costs by $250+ in many cases. Those who boost scores by 150+ points may enjoy even more dramatic savings.

What Steps Can I Take to Reduce Car Insurance in the UK?

Luckily, UK regulators restrict insurers from applying credit scoring models as heavily as in other countries. However, improving your insurance credit rating remains one of the most effective ways to reduce car insurance premium costs.Aim to check your score from both LexisNexis and TransUnion annually. Then examine credit reports to identify and resolve any errors or issues weighing down your rating.

Does Car Insurance Cost Less at Certain Ages in the UK?

UK insurers definitely apply age more heavily than credit when determining auto insurance rates. Premiums begin decreasing around ages 30-35 assuming a clean driving history. Those under 25 pay the highest rates on average. Premium costs start increasing again around age 65. So drivers in the 30-55 age range tend to pay the least for coverage since they balance experience with lower risk.

Why Does Car Insurance Remain High Despite a Clean Driving Record?

Outside of improving credit scores discussed above, usage-based insurance programs provide the best option for lowering premiums for safe UK drivers with clean records. These telematics plans track real driving behaviour and reward those who minimize phone distractions, maintain low mileage, and avoid sudden acceleration/braking. Significantly discounted premiums based predominantly on individual driving safety rather than demographics offer the most potential savings.

Improving Credit Scores to Save on Premiums

Insurance Credit Scoring Factors into Premiums

Unbeknownst to many consumers, car insurance carriers utilize "insurance credit scores" when developing pricing for policies. These proprietary scores differ from standard credit reporting agency ratings but remain highly influential in determining what motorists ultimately pay.

Insurers apply actuarial data showing that those with higher credit scores tend to experience fewer claims. As such, companies charge higher premiums to drivers with poor insurance credit ratings to account for increased projected loss costs.

How to Check and Improve Your Insurance Credit Score

The first step involves checking your current insurance credit rating by requesting a score from either LexisNexis or TransUnion. Both agencies develop specific scoring models for insurance providers. Understanding your baseline score makes it possible to track improvement over time.

The next step requires analyzing your credit reports and addressing any issues or errors negatively impacting your rating. Pay off outstanding balances whenever possible and keep usage of available credit low. Verifying that all personal information is displayed correctly can also help increase your score.

Aim for Long-Term Score Building to Save

While increasing insurance credit ratings takes dedication and diligence, the payoff makes the effort worthwhile. Those seriously committed can realistically add 80+ points over 12 months through careful credit management.

Remember that insurers evaluate credit scores at each annual policy renewal. So drivers should focus on continually building credit over multiple years to maximize car insurance discounts. The savings clearly justify setting a goal to ultimately reach the highest credit rating tier possible.

Other Useful Articles:

- Effects of Car Modifications on Your Insurance Policy: A Comprehensive Guide

- Car Modifications You Didn't Know Were Illegal

- Top 10 Value For Money Car Mods

- Best Cars to Customize: Unleashing Your Automotive Creativity

- Is Modifying Your Car Dangerous?

- Which car modifications are against the law?

So, what's your car story? Share it with us, and let's keep the engines of passion running!

Other Useful Sites To Check Out That We Have Partnered With To Bring You Even More Content

TUNINGBLOG.EU SWIPE AUTOMOTIVE RACEWARS USA DYLER.COM

Do you need a Quality Photographer? Our photographers are Available HERE

All of our Magazines can be found on Amazon, they Print and Deliver worldwide, Stance Auto can not be held responsible for the final print, and all complaints and returns must be directed to Amazon.

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

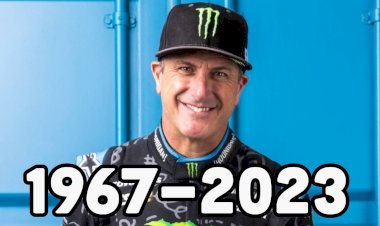

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)