How to Insure Your First Car Without Paying a Fortune

Struggling to find cheap car insurance as a new driver? Learn how to insure your first car without breaking the bank with real tips from the car community.

Why Car Insurance Feels So Expensive for New Drivers

Let’s be honest—nothing bursts the bubble of buying your first car quite like the first insurance quote. You go from dreaming about JDM mods and stance goals to staring at a screen asking for £2,000 a year just to get on the road. Welcome to the UK insurance game.

The reason it feels brutal is because insurers work on risk. And when you're new behind the wheel, statistically, you're more likely to have an accident. They don’t know your driving habits yet, and without a no-claims history, they simply play it safe—by charging you more. Age, postcode, job title, the car itself… everything plays a role. But the good news? You’re not stuck with sky-high premiums forever. There are plenty of smart moves that can drop your costs significantly without compromising cover.

Choose the Right First Car for Lower Insurance Costs

This might sound obvious, but the car you drive matters—a lot. Smaller, lower-powered cars are always cheaper to insure. Think 1.0L to 1.4L engines, and preferably models with good safety ratings and no performance mods (yet).

Cars like the Toyota Aygo, Hyundai i10, Ford Ka, or Vauxhall Corsa are solid choices. Even the Honda Jazz, while not the sexiest name in the car scene, will keep premiums low and reliability high. A clean, stock car is always the best start. Once you’ve got a year of no-claims, then you can start planning your modified car journey properly.

The Truth About Black Boxes: Are They Worth It?

Ah yes, the infamous black box. Love it or hate it, a telematics device is often the quickest way to slash your premium as a first-time driver. It monitors your speed, acceleration, braking, and even what time of day you drive. Some people find it intrusive, but if you’re a careful driver, it can genuinely save you hundreds—sometimes even over £1,000 in your first year.

Most companies now offer optional black box policies with the promise of lower premiums if you drive well. Just be sure to read the small print—some providers penalise driving at night, even if you're doing nothing wrong. Still, if it helps you get on the road without bankrupting yourself, it’s absolutely worth considering.

Adding a Named Driver Can Help—But Be Careful

One of the oldest tricks in the book is to add a parent or more experienced driver as a named driver on your policy. It’s totally legal, and it can reduce your risk profile in the eyes of the insurer. Just make sure you are the main driver, especially if you’re the one using the car daily. If not, it becomes “fronting”—a form of insurance fraud that could invalidate your policy.

Done correctly, though, this is a smart move. It adds a layer of responsibility and signals that you're not the only one with access to the car.

Compare Like a Pro: Don’t Just Use One Website

Don’t fall into the trap of using just one comparison site. Every site works with different insurance providers, so the prices can vary wildly. It’s worth checking Compare The Market, Confused.com, MoneySuperMarket, and GoCompare separately.

And here’s a lesser-known trick: after using a comparison site, go directly to the insurer’s website. Some offer better rates if you book through them directly. Also, try clearing your cookies or switching to incognito mode. Some users have reported cheaper quotes doing this because sites track your interest.

Pay Annually If You Can—It's Way Cheaper

It stings upfront, but paying in one go can save you a big chunk of money. When you pay monthly, you’re essentially taking out a loan with interest. Some insurers charge APRs as high as 25–30% over 12 months. If you can save up and pay your first policy annually, it’ll leave more money in your pocket over the year—money you could spend on wheels, a splitter, or your next Stance Auto Magazine subscription.

Be Honest About Mods (Or Pay Later)

We know how tempting it is to install a cheeky backbox, some LED strips, or even fit your car with aftermarket wheels without telling your insurer. But here’s the reality—any undeclared modification can void your insurance entirely. That means if you crash or get hit, you’re on your own financially.

That said, not all mods raise your premium. Some insurers are actually fine with cosmetic changes like tints, stickers, or wheel swaps—as long as they’re notified. A few even have specialist policies for modified cars, so it’s worth calling around and being upfront. Companies like Adrian Flux, Greenlight Insurance, and Brentacre are more mod-friendly than mainstream providers.

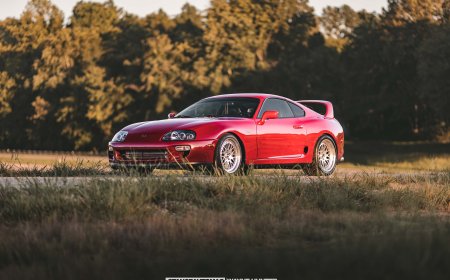

What About Classic or JDM Cars? Can New Drivers Insure Them?

It depends. Insuring a JDM car like an imported Civic or MX-5 as a first-time driver is definitely possible, but it’s not always cheap. Insurers might not recognise the chassis codes or import spec, which makes quotes harder to obtain. Specialist insurers are usually better equipped here.

As for classics—some older cars (25+ years) can actually be insured under classic car insurance, even for young drivers. These policies often come with mileage limits, but they can be surprisingly cheap and include agreed values, cover for shows, and even modifications. Again, it all comes down to how you use the car, and whether it’s your daily or your weekend toy.

Top Tips That Actually Work to Lower Insurance

It’s not all about your car. Where you park it overnight, what job title you list, and even when you buy the policy can make a difference. Parking on a driveway or in a garage is safer (and cheaper) than parking on the street. Job titles matter too—“student” might cost more than “retail assistant” or “administrative support,” even if it’s basically the same role.

Also, timing matters. Buying your policy about 21–26 days before it starts often yields lower prices than leaving it to the last minute. Weird, but it works.

Final Thoughts: Insuring Your First Car Doesn’t Have to Hurt

We get it—insurance feels like the least exciting part of car ownership. But once it’s sorted, you can finally enjoy your car, get out on the road, and start building your dream. Whether you're eyeing a full stance transformation or just want to commute in style, a smart insurance setup gives you the freedom to focus on what really matters—driving.

So don’t settle for the first price you’re given. Shop around, stay honest, and consider every option. Then, once you're rolling, come share your build story with us at Stance Auto Magazine. Whether it’s a stanced i10 or a clean Civic build, we want to hear about it—and so does the rest of the car community.

Further Reading

Call to Action

Do you have a build story like this one? Got a build on a budget? We want to see it. Submit your story to Stance Auto Magazine, and you could be the next featured owner showing the world how to do it right—without breaking the bank.

And hey, don’t forget to tag us on socials. Use #stanceautomag on Instagram, Pinterest and Facebook so we can see (and maybe feature) your ride.

Order Your Car Magazines From Our Amazon Book Store

Get Noticed Use our Hashtags - #stanceauto #stanceautomag #stanceautomagazine #modifiedcarmagazine

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)