What Car Should I Buy for My Daughter – Insurance: How to Save

Discover how to save money on your daughter’s first car insurance with the right car, smart policy choices, and insider tips for cheaper premiums.

TL;DR

-

Choosing a car in insurance groups 1–5 with built-in safety features keeps premiums low for first-time drivers.

-

Telematics (black box) insurance and adding a named adult driver can drastically cut costs.

-

Avoid mods, shop around, and check excess levels—these all affect premiums more than you think.

Why Insurance Costs So Much for Young Drivers

If you’re buying a first car for your daughter, there’s one reality you’ve probably already faced: the insurance is more than the car itself. For 17 to 20-year-old drivers, average premiums in the UK hover around £1,800 a year—and that’s on the low end.

Why? Insurers know younger drivers are statistically more likely to be involved in accidents. It’s nothing personal—it’s purely based on years of crash data. But there are ways to beat the system without compromising safety or style.

Let’s walk through the smartest ways to keep costs down, from car choice to clever policy tweaks.

Read This Article: How can I save money on my car insurance?

Start With the Right Car (It Makes All the Difference)

Before you even start comparing quotes, you need to know this: the car your daughter drives sets the tone for everything else.

Cars in insurance groups 1 to 5 are your golden ticket. These are usually small-engine hatchbacks with strong safety records, low repair costs, and minimal power.

Here are a few tried-and-true first cars that consistently return the lowest premiums for young drivers:

-

Hyundai i10

-

Skoda Fabia

-

Kia Picanto

-

Toyota Aygo

-

Volkswagen Up!

-

Vauxhall Corsa (basic trims)

-

Ford Fiesta (older, low-spec models)

Stick to engines under 1.2L, avoid sporty trims or turbos, and steer clear of anything modified. Even a rear spoiler can bump up the risk rating with some providers.

Use Black Box Insurance to Your Advantage

Telematics insurance—also known as a black box policy—can cut premiums by over 50% if your daughter drives safely. Insurers fit a small GPS device (or use a smartphone app) to monitor driving style, speed, braking, time of travel, and cornering.

If she sticks to daytime driving, stays under the speed limit, and avoids heavy braking, she’ll likely qualify for premium reductions or cash-back rewards.

Many black box providers now offer no curfew options, so she can still drive at night without penalties—perfect if she’s working shifts or studying late.

Add an Experienced Named Driver (But Don’t Front)

One of the easiest and legal ways to lower premiums is to add an experienced, claim-free driver (like a parent) as a named driver on the policy. This can reassure insurers that the risk is spread and not solely on a brand-new motorist.

Important: Don’t list yourself as the main driver if she’s using the car most often. That’s called “fronting” and it’s considered insurance fraud. Not only can it void the policy, it can get you fined and prosecuted.

Instead, list her as the main driver, and yourself or another parent as a named driver.

Shop Smart and Compare Quotes the Right Way

Comparison sites like MoneySuperMarket, CompareTheMarket, and GoCompare are great—but don’t just stop at the first quote. Here's what most people overlook:

-

Try different job titles—some small wording tweaks can shift risk levels. For example, “sales assistant” may quote differently than “retail assistant.”

-

Experiment with different excess levels. Sometimes increasing voluntary excess from £250 to £500 can drop the premium.

-

Check third-party vs comprehensive. Ironically, third-party only can cost more than comprehensive because riskier drivers often choose it.

And don’t forget to clear your cookies or use incognito mode. Insurers track repeat visits, and sometimes your prices can go up just by checking too often.

Pay Annually, Not Monthly

It’s tempting to pay monthly, especially for younger drivers with limited funds, but this usually adds 20–30% interest on top of the premium. If you can, pay the whole thing upfront—you’ll save hundreds over the year.

Alternatively, pay it with a 0% credit card and pay that off monthly—just make sure you don’t rack up interest or miss payments.

Avoid Mods, Even Cosmetic Ones

Here’s the part that car enthusiasts hate hearing—modifications, even minor ones, can send premiums skyrocketing.

That means:

-

Alloy wheels

-

Aftermarket stereos

-

Lowered suspension

-

Body kits or tints

All of it makes the car more attractive to thieves, more expensive to repair, or assumed to be driven more aggressively. Best to keep it stock until she builds up a few years of no-claims bonus.

Read This Article: Effects of Car Modifications on Your Insurance Policy: A Comprehensive Guide

Keep That No-Claims Bonus Clean and Climbing

Speaking of bonuses—the no-claims bonus is gold. Even one full year without a claim can drop premiums massively. That’s why it’s better to choose a comprehensive policy with added windscreen and breakdown cover—it prevents minor claims from costing more in the long run.

Some providers offer “named driver no-claims” too, so if she’s not the policyholder but still driving regularly, it can build credit for when she takes her own policy later.

Final Thoughts: Strategy Over Sacrifice

Getting affordable insurance for your daughter isn’t about sacrificing safety or confidence—it’s about working the system smartly.

Choose the right car, avoid unnecessary extras, and explore every discount option available. From adding a named driver to installing a black box, the goal is to balance independence with security.

If done right, you’ll not only save hundreds each year, but also help your daughter build her driving history safely and responsibly—setting her up for a future of lower premiums and stress-free motoring.

Related Articles We Could Also Publish

-

What Car Should I Buy for My Daughter – Safety Features Explained

-

What Car Should I Buy for My Daughter – Insurance: How to Save

-

What Car Should I Buy for My Daughter – Petrol vs Hybrid vs EVs

-

What Car Should I Buy for My Daughter – Used Car Buying Checklist

-

What Car Should I Buy for My Daughter? Safe, Cheap & Reliable

Call to Action

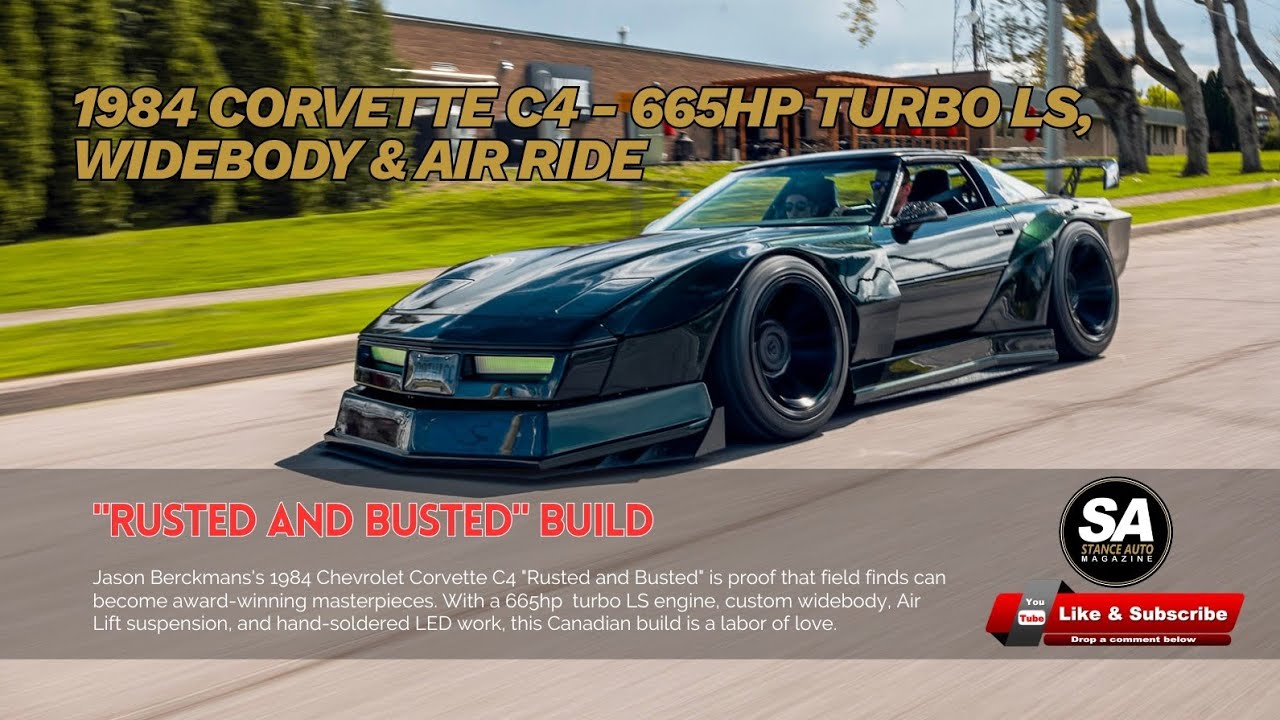

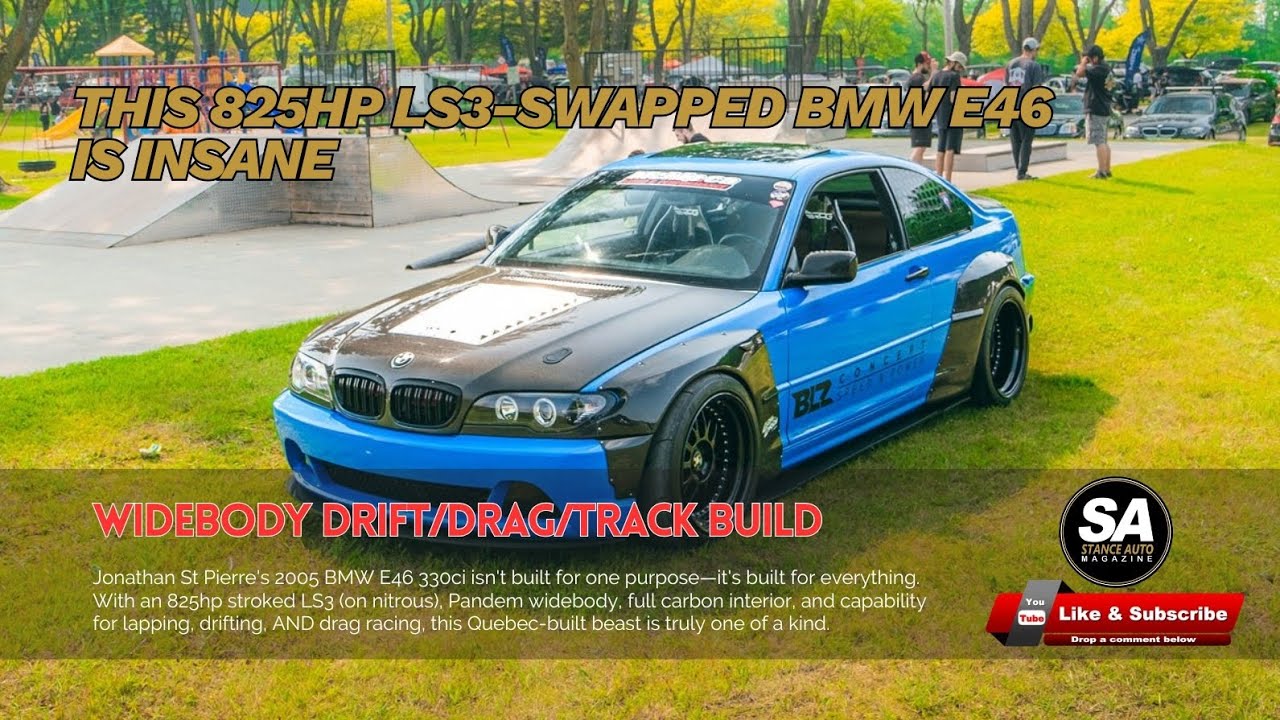

Do you have a build story like this one? Got a build on a budget? We want to see it. Submit your story to Stance Auto Magazine, and you could be the next featured owner showing the world how to do it right—without breaking the bank.

And hey, don’t forget to tag us on socials. Use #stanceautomag on Instagram, Pinterest and Facebook so we can see (and maybe feature) your ride.

Order Your Car Magazines From Our Amazon Book Store

Get Noticed Use our Hashtags - #stanceauto #stanceautomag #stanceautomagazine #modifiedcarmagazine

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)