Mistakes to Avoid When Claiming Mis-Sold Car Finance

Avoid common mistakes when claiming mis-sold car finance. Learn how to strengthen your case, avoid pitfalls, and maximise your chances of compensation.

TL;DR

-

Common Errors: Missing documents, weak evidence, ignoring deadlines, or relying blindly on “no win, no fee” services.

-

Strengthen Your Claim: Keep thorough records, understand FCA rules, and follow proper complaint procedures.

-

DIY vs Services: Careful preparation can allow a successful claim without paying hefty fees to a third party.

Introduction

Car finance claims are rising across the UK, as more drivers discover that their PCP or HP agreements were mis-sold. Hidden commissions, unclear terms, and unfair APRs often leave consumers paying more than they should, yet many miss their chance to reclaim funds simply because of preventable mistakes.

Avoiding common pitfalls is critical. Missing deadlines, submitting weak evidence, or relying on claims services without understanding their fees can all reduce the likelihood of compensation. With proper preparation, DIY methods, or professional support from services like ClaimForCars.com, you can reclaim what’s rightfully yours.

This guide highlights frequent mistakes, how to strengthen your claim, and the choices available to ensure maximum recovery.

Mistake 1: Missing or Incomplete Documentation

Claims often fail when essential evidence is missing. Keep copies of:

-

Finance agreement (PCP or HP)

-

Dealer invoices and correspondence

-

Bank statements showing payments

-

Emails or messages with the dealer

Even small missing documents, like a single email confirming terms, can slow or derail your claim.

Mistake 2: Ignoring Deadlines

-

Finance providers: Usually respond within 8 weeks.

-

Financial Ombudsman Service: Complaints must be submitted within 6 years from the agreement date.

Timely action ensures your claim remains valid and maximises the chance of success. Keep a timeline of events for reference.

Mistake 3: Relying Blindly on “No Win, No Fee” Services

Services like ClaimForCars.com can be helpful, but:

-

Fees are often a percentage of the payout.

-

Some services may not handle complex claims.

-

DIY claims using MoneySavingExpert guidance can reclaim 100% of the compensation if done correctly.

Always check terms and understand fees before committing.

Mistake 4: Weak Evidence or Claims

Avoid vague or unsupported assertions. Strengthen your case by:

-

Highlighting specific clauses in your finance agreement

-

Comparing APR and fees with market rates at the time

-

Documenting pressure tactics or misrepresentation by the dealer

-

Using complaint templates from MoneySavingExpert

Mistake 5: Failing to Escalate

Some consumers accept the first response from a finance provider without escalation. Remember:

-

You can escalate to the Financial Ombudsman.

-

Provide additional evidence if necessary.

-

Appeal partial settlements to maximise recovery.

Tips for a Strong Claim

-

Document Everything – paper and digital copies of all correspondence.

-

Understand Your Rights – FCA regulations and Ombudsman guidelines protect consumers.

-

Follow Templates – MoneySavingExpert offers structured complaint templates.

-

Be Persistent – Claims can take weeks or months; follow up regularly.

-

Choose the Right Route – DIY keeps full compensation; services reduce stress but take fees.

Helpful links:

Conclusion

Avoiding common mistakes is key to reclaiming mis-sold car finance successfully. Keep thorough documentation, act within deadlines, and carefully choose whether to handle your claim DIY or via ClaimForCars.com. With preparation, persistence, and knowledge of pitfalls, recovering hidden fees or unfair charges is entirely possible.

Related Articles:

Call to Action

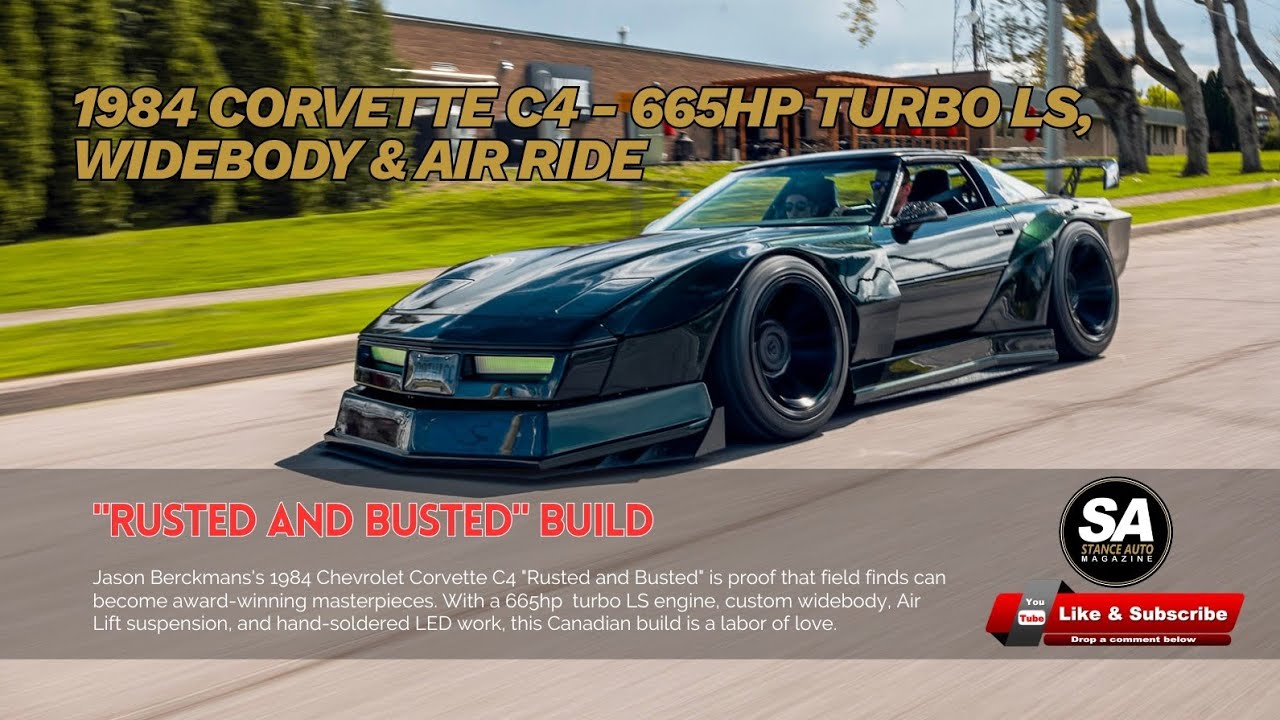

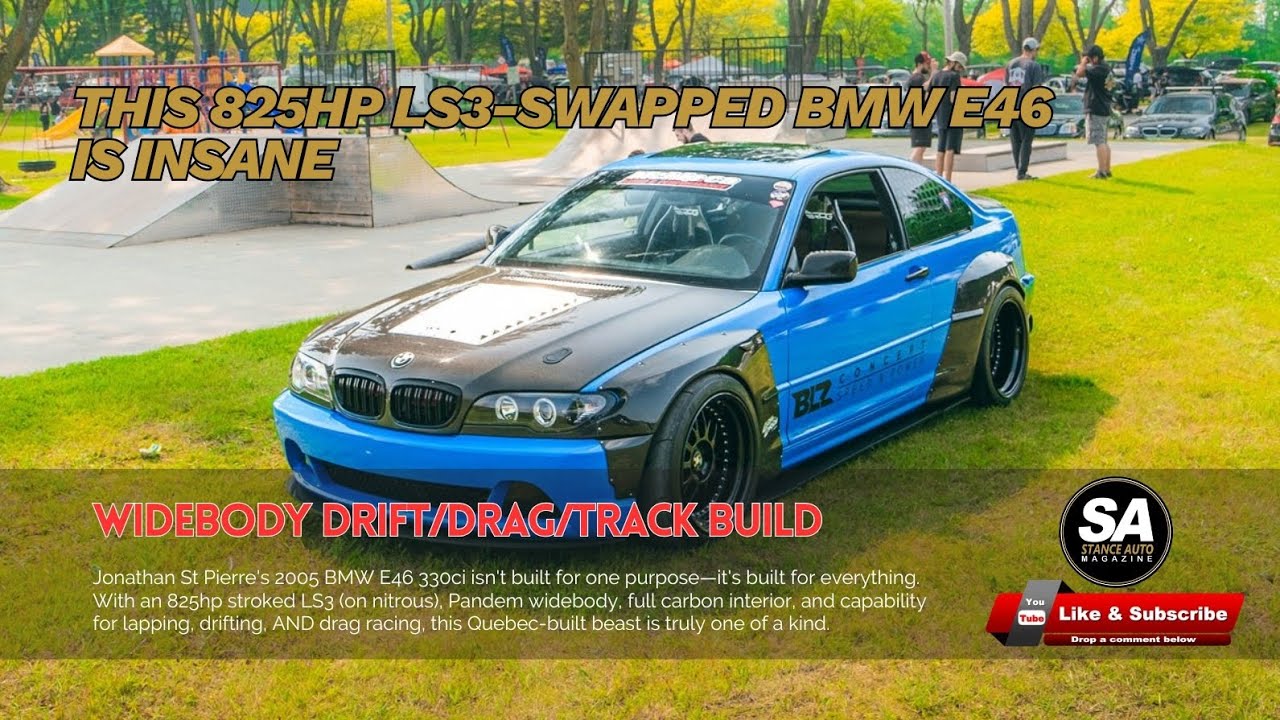

Do you have a build story like this one? Got a build on a budget? We want to see it. Submit your story to Stance Auto Magazine, and you could be the next featured owner showing the world how to do it right—without breaking the bank.

And hey, don’t forget to tag us on socials. Use #stanceautomag on Instagram, Pinterest and Facebook so we can see (and maybe feature) your ride.

Test Your JDM Car Knowledge and Take Our No. 1 JDM Car Quiz

Order Your Stance Auto Car Magazines From Our Amazon Book Store

Test Your Automotive Knowledge and Take Our No. 1 Car Quiz

Get Noticed Use our Hashtags - #stanceauto #stanceautomag #stanceautomagazine #modifiedcarmagazine

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)