Common Car Finance Mis-Selling Tricks

Learn the common mis-selling tricks used in PCP and HP agreements, how to spot them, and how to protect yourself from unfair car finance deals.

TL;DR

-

The Tricks: Dealers and lenders sometimes use hidden fees, inflated interest rates, and unclear terms to profit at your expense.

-

Spotting Mis-Selling: Learn the signs of unfair PCP or HP agreements and what documentation to check.

-

Next Steps: DIY claims using MoneySavingExpert guidance or escalation via the Financial Ombudsman can help reclaim lost money.

Introduction

Car finance can be a lifeline, letting drivers spread the cost of a new or used vehicle over months or years. But all too often, what seems like a simple PCP or HP agreement hides pitfalls that can leave you paying far more than necessary. Dealers may sneak in hidden commissions, inflate interest rates, or obscure balloon payments, all while consumers believe they’re getting a fair deal. These mis-selling practices are more common than many realise, and they’re exactly why understanding the signs is critical before taking any action.

Knowing the tricks gives you the edge to spot problems early, reclaim money, and avoid falling victim again. With clear guidance, you can navigate your complaint process confidently — whether DIY or with a service like ClaimForCars.com — and ensure that hidden fees and unfair practices don’t drain your wallet.

Common Mis-Selling Tricks

Dealers and lenders can use a range of tactics to maximise profits at your expense. Some of the most frequent include:

-

Hidden Dealer Commissions: Extra charges added to your finance that aren’t explained.

-

Inflated APRs: Interest rates higher than the standard market rate without proper disclosure.

-

Balloon Payments: Large final PCP payments that aren’t clearly explained upfront.

-

Rushed Agreements: Pressure sales tactics or signing without fully understanding the terms.

-

Misrepresented Terms: Mileage limits, early termination fees, or hidden charges buried in fine print.

Recognising these tactics is essential, especially before pursuing a claim or filing a complaint.

How to Spot Mis-Selling

To evaluate your agreement, check for:

-

APR above advertised or market standards

-

Unexpected fees or commissions

-

Vague or complex contract clauses

-

High-pressure sales experiences

-

Lack of alternative finance options offered

Gather all relevant documentation to support your claim — agreements, dealer correspondence, and bank statements — as evidence is key to success.

Protect Yourself

Even if your agreement is already signed, you can take immediate steps:

-

Document Everything: Keep all paperwork and correspondence in an organised file.

-

Read the Fine Print: Understand every clause of your PCP or HP agreement.

-

Check APR and Fees: Compare them to other deals available at the time.

-

File a Complaint: Contact your finance provider first, then escalate to the Financial Ombudsman if necessary.

-

DIY vs ClaimForCars.com: Decide if you want full control with DIY (and 100% of compensation) or convenience using a professional service.

Helpful Links:

Conclusion

Awareness of common mis-selling tricks empowers you to protect yourself and reclaim compensation if necessary. Whether tackling the claim yourself or using ClaimForCars.com, being prepared with evidence and understanding the tactics used by some dealers is the first step to getting your money back.

Related Articles:

What To Do If Your Car Finance Is Mis-Sold

TL;DR

-

Immediate Steps: Gather all paperwork, review your PCP or HP agreement, and check for hidden fees or unfair APRs.

-

Escalation: File a complaint with your finance provider and escalate to the Financial Ombudsman if needed.

-

DIY vs Services: Decide whether to handle it yourself using MoneySavingExpert guidance or enlist ClaimForCars.com for expert help.

Introduction

Thousands of UK drivers realise too late that their PCP or HP finance agreements were mis-sold. Hidden fees, inflated interest rates, and unclear contract terms often leave consumers paying far more than necessary. Acting promptly is critical — the sooner you identify mis-selling, the better your chances of reclaiming money.

Understanding what to do and how to escalate a claim can save you stress, time, and potentially thousands of pounds. Whether you prefer handling the claim yourself or using professional services like ClaimForCars.com, knowing the right steps ensures you’re fully prepared and improves the likelihood of success.

Step 1: Gather Your Documentation

Collect all relevant documents before contacting your lender or service:

-

Finance agreement (PCP or HP)

-

Dealer invoices and correspondence

-

Bank statements showing payments

-

Emails or messages with the dealer or lender

Having everything ready strengthens your case and speeds up the process.

Step 2: Review Your Agreement

Look for signs of mis-selling:

-

APR higher than expected

-

Hidden fees or commissions

-

Balloon payments or early termination charges

-

Unclear or rushed terms

Highlight any clauses that seem unfair or misrepresented, and compare them to market standards at the time of signing.

Step 3: File a Complaint With Your Finance Provider

Contact your lender directly with a clear, factual description of the issue:

-

Include all supporting documentation.

-

Keep copies of all correspondence.

-

Expect a response within 8 weeks.

If your complaint is rejected or ignored, escalate to the Financial Ombudsman.

Step 4: Escalate to the Financial Ombudsman

The Ombudsman is independent and free, capable of overruling finance providers and awarding compensation for mis-selling. Submit all supporting evidence and correspondence to maximise your chance of success.

Useful link: Financial Ombudsman – Car Finance Complaints

Step 5: DIY vs ClaimForCars.com

Decide if you want to handle your claim yourself or enlist professional help:

DIY:

-

Full control and keeps 100% of any compensation.

-

Requires time, research, and persistence.

-

MoneySavingExpert offers templates and advice: Mis-sold Finance DIY Tips

ClaimForCars.com:

-

Handles paperwork, correspondence, and escalation.

-

Operates on a “no win, no fee” basis, taking a portion of any payout.

-

Reduces stress and increases efficiency for complex claims.

Step 6: Stay Organised and Patient

-

Keep all documents, emails, and notes.

-

Expect the process to take weeks or months.

-

Regularly follow up with your lender or service.

Persistence is key — both DIY and professional claimants often reclaim hundreds or thousands in hidden fees or inflated APRs.

Conclusion

If your PCP or HP finance agreement was mis-sold, following these steps ensures you are prepared to reclaim compensation. With careful documentation, timely action, and knowledge of your options — DIY or ClaimForCars.com — you can successfully challenge unfair deals without a solicitor.

Related Articles:

Call to Action

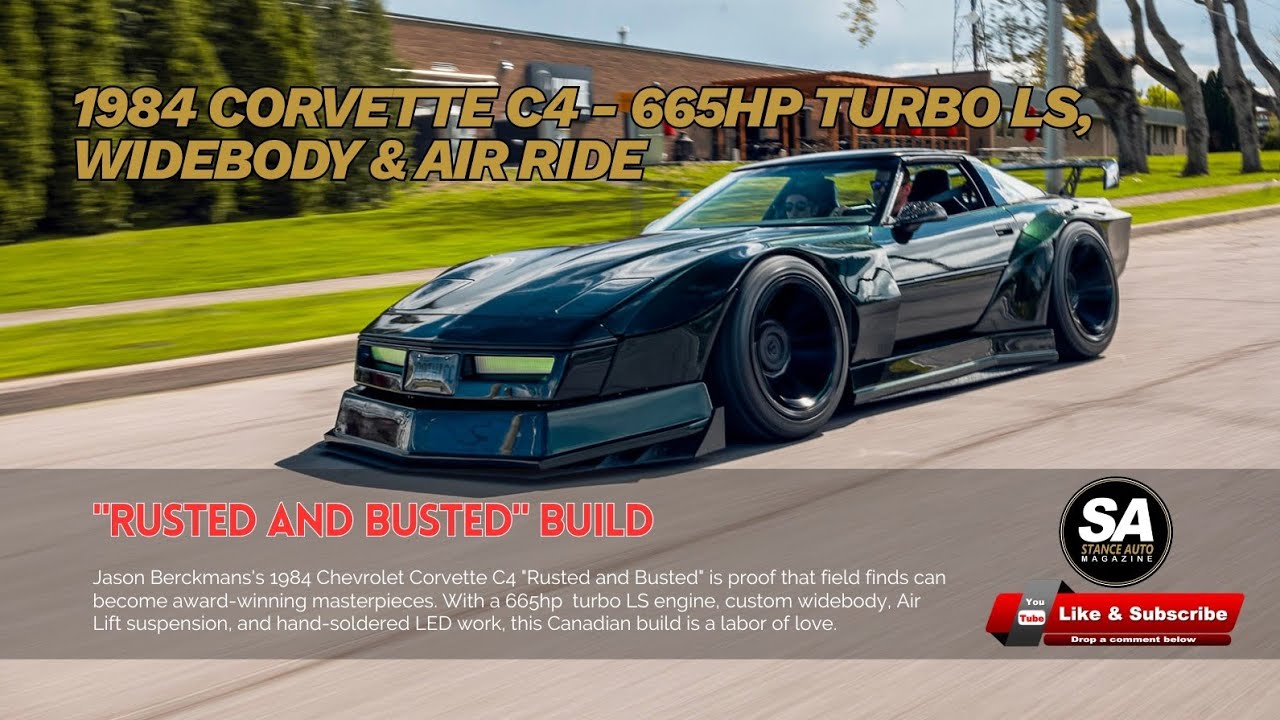

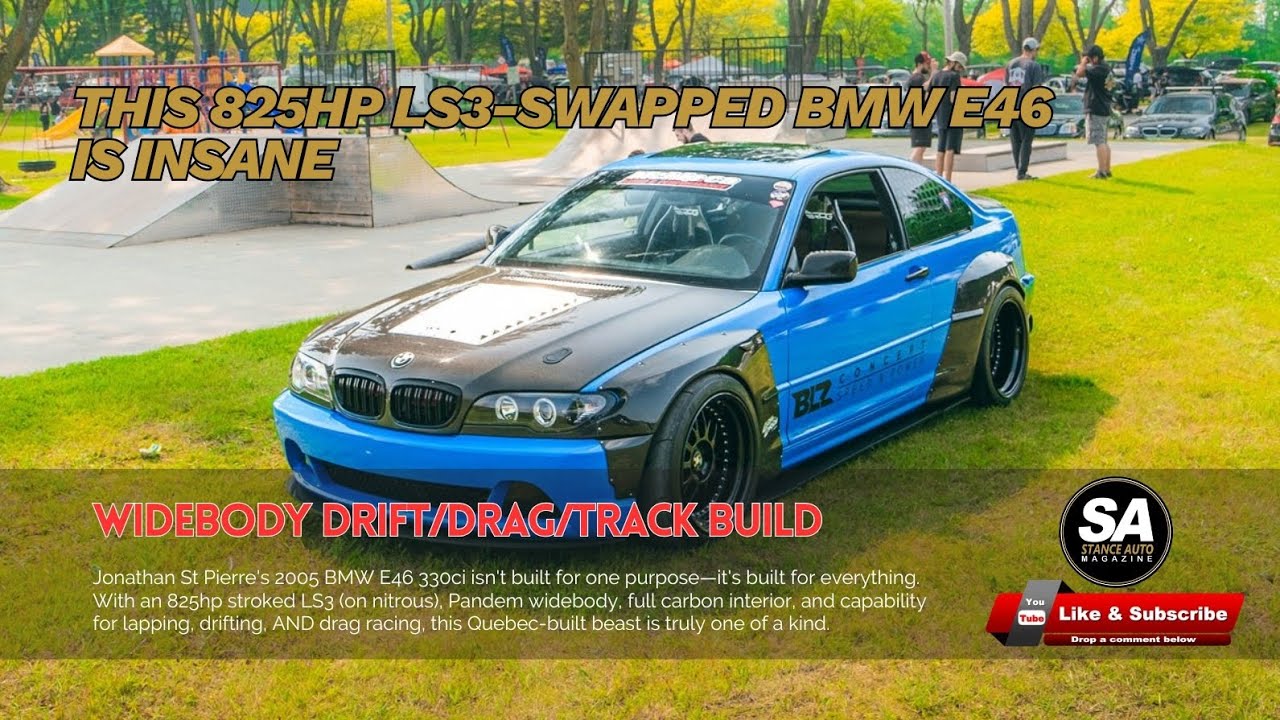

Do you have a build story like this one? Got a build on a budget? We want to see it. Submit your story to Stance Auto Magazine, and you could be the next featured owner showing the world how to do it right—without breaking the bank.

And hey, don’t forget to tag us on socials. Use #stanceautomag on Instagram, Pinterest and Facebook so we can see (and maybe feature) your ride.

Test Your JDM Car Knowledge and Take Our No. 1 JDM Car Quiz

Order Your Stance Auto Car Magazines From Our Amazon Book Store

Test Your Automotive Knowledge and Take Our No. 1 Car Quiz

Get Noticed Use our Hashtags - #stanceauto #stanceautomag #stanceautomagazine #modifiedcarmagazine

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)