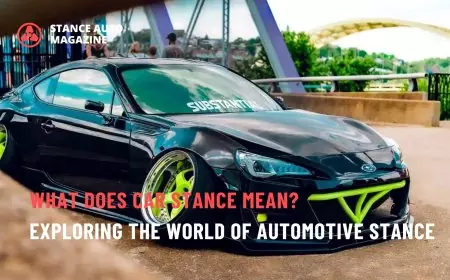

Modified Car Insurance Explained: How to Get the Best Deal (And What Happens If You Don't Declare)

Everything you need to know about modified car insurance in 2026. Specialist brokers, declaration requirements, what affects premiums, and the real consequences of not declaring mods.

The Insurance Conversation Nobody Wants to Have (But Absolutely Must)

Let's talk about the least exciting part of modifying your car: insurance. It's not glamorous, it's not fun to think about, and it's definitely not the bit you get to show off on Instagram. But here's the uncomfortable truth that needs to be said loudly and clearly: if you modify your car and don't declare it to your insurance company, you are driving uninsured. Not "kind of" uninsured. Not "technically but not really" uninsured. Actually, genuinely, legally uninsured — and if you have an accident, make a claim, or get pulled over, the consequences are going to be absolutely devastating.

We're not trying to scare you. We're trying to save you from making a mistake that could cost you thousands of pounds, points on your licence, a criminal record, and potentially your car. Because here's what happens when you don't declare modifications and then need to make a claim: your insurer investigates, discovers the undeclared mods, voids your policy entirely, refuses to pay out a penny, and reports you to the Insurance Fraud Bureau. You're then left personally liable for any damage you've caused — which, in a serious accident, can easily run into tens or even hundreds of thousands of pounds. And on top of that, you'll struggle to get insurance again for years, because you'll be flagged as a fraud risk.

This article exists to make absolutely sure that doesn't happen to you. We're going to explain exactly how modified car insurance works in the UK, which modifications actually affect your premium (and how much), how to find specialist insurers who understand the modified car scene, what happens if you fail to declare mods, and how to get the best possible deal without cutting corners or taking stupid risks. This is everything you need to know about insuring a modified car in 2026, explained properly, by people who've been in the scene for years and have seen it all go right — and horribly wrong. Over at Stance Auto Magazine, we've watched thousands of builds come together, and the single biggest regret we hear from people is "I wish I'd sorted my insurance properly from the start."

What Counts as a Modification? (Spoiler: Pretty Much Everything)

The first thing you need to understand is that insurance companies have a very, very broad definition of what counts as a "modification." In their eyes, a modification is any change made to your vehicle that differs from the manufacturer's original factory specification. And yes, that really does mean any change. We're not just talking about big-ticket performance mods like turbos and remaps. We're talking about genuinely tiny, seemingly inconsequential changes that you might not even think of as modifications at all.

The Obvious Modifications

Let's start with the stuff that everyone knows needs to be declared. Performance modifications — things like engine remaps, turbo or supercharger kits, exhaust systems, upgraded brakes, lowered suspension, coilovers, air suspension, short shifters, limited-slip differentials, and nitrous oxide systems — all of these massively affect your insurance. They're designed to make your car faster, louder, or handle better, and insurers see them as increasing the risk of you driving more aggressively or being involved in an accident. These mods will almost always push your premium up, sometimes significantly.

Cosmetic modifications also need to be declared, even though they don't affect how the car performs. This includes body kits, spoilers, custom paint jobs, wraps, aftermarket wheels and alloys, window tints, custom interiors, aftermarket seats, upgraded sound systems, LED lighting upgrades, and even something as minor as changing your gear knob or adding seat covers. Yes, really. Seat covers. Because from an insurer's perspective, any change to the car's original spec is a modification, and they want to know about it.

The Modifications You Didn't Realise Count

Here's where it gets ridiculous. A lot of insurers will also class the following as modifications that must be declared: tow bars, roof racks, bike racks, dashcams, parking sensors, reversing cameras, aftermarket stereos, phone mounts, and even air fresheners hanging from your rearview mirror (if they obstruct your view). Some insurers have been known to ask about whether you've got non-standard floor mats. It sounds absurd, but the logic is that anything that changes the car from its factory state is technically a modification, and if you don't declare it and they find out later, they can use it as grounds to void your policy.

The rule of thumb is this: if you've changed it, added it, removed it, upgraded it, or customised it in any way, you need to tell your insurer. Don't assume it's too small to matter. Don't assume they won't care. Don't assume you can get away with not mentioning it. Declare everything, and let them decide whether it affects your premium. It's genuinely the only safe way to do this. As we covered in our complete guide to car guy questions, transparency is everything when it comes to insurance.

Why Modifications Increase Your Insurance Premium (And Which Ones Hit Hardest)

So why do modifications make your insurance more expensive? The answer comes down to risk, and insurers are very, very good at calculating risk. When you modify your car, you change the risk profile in several ways, and insurers price that into your premium. Let's break down the main factors.

Increased Theft Risk

Modified cars — especially ones with expensive aftermarket parts like forged wheels, high-end exhausts, or turbo kits — are much more likely to be stolen or broken into. Thieves know that a set of BBS wheels can be worth £3,000+ and can be stripped off a car in minutes, and they actively target modified cars for this reason. If your car is statistically more likely to be stolen, your insurer has to charge more to cover that risk.

Higher Repair and Replacement Costs

If you've spent £2,000 on a set of custom wheels, £1,500 on a stainless steel exhaust, and £800 on a body kit, and then you're involved in an accident that damages those parts, the insurer has to pay to replace them like-for-like. That's significantly more expensive than replacing the standard factory parts, which means the potential payout in the event of a claim is much higher. Insurers price this into your premium.

Performance and Driving Style Assumptions

This is the big one, and it's where things get controversial. Insurers use statistical data that shows a correlation between people who modify their cars for performance and people who drive more aggressively or take more risks on the road. Whether that's fair or not is beside the point — the data exists, and underwriters use it to calculate premiums. A car with a remap, bigger turbo, and upgraded brakes is seen as more likely to be driven hard, which increases the likelihood of an accident. Fair or not, that's the logic.

Which Modifications Hit Your Premium Hardest?

Not all modifications affect your premium equally. Here's a rough hierarchy based on what we've seen in the real world:

Lowest Impact: Roof bars, tow bars, dashcams, parking sensors, upgraded security systems (these can sometimes even lower your premium), standard aftermarket wheels in the same size as factory.

Medium Impact: Body kits, wraps, window tints, aftermarket exhausts (cat-back), lowered suspension, coilovers, upgraded brakes, larger wheels.

High Impact: Engine remaps, turbo or supercharger kits, nitrous oxide systems, engine swaps, significant power increases, heavily modified interiors, airbag suspension, widebody kits.

The more extreme the modification, the harder it'll hit your wallet. A basic set of lowering springs might add £50–£100 to your annual premium. A full turbo conversion with supporting mods could add £500–£2,000 or more, depending on your age, location, and driving history.

Mainstream Insurers vs Specialist Brokers: Why You Need the Right One

Here's a reality check: if you walk into a mainstream insurance company with a heavily modified car, there's a very good chance they'll either refuse to insure you outright, or they'll quote you a premium so eye-wateringly high that it's essentially a polite "no thanks." Mainstream insurers like Direct Line, Aviva, and Churchill are set up to insure standard cars driven by average drivers, and their systems simply aren't designed to handle the nuance and complexity of modified vehicles. Their call centre staff often have no idea what a "cat-back exhaust" or "coilovers" are, and they're working from rigid drop-down menus that don't account for the specifics of your build.

This is where specialist modified car insurance brokers come in, and they're genuinely game-changing. These are companies that understand the modified car scene, employ staff who actually know about cars, and have access to underwriters who specialise in insuring modified vehicles. They know the difference between a cosmetic mod and a performance mod, they understand that not all remaps are the same, and they can offer policies that actually protect the value of your modifications rather than just reverting you to a standard payout.

The Big Names in Specialist Modified Car Insurance

Adrian Flux is probably the most well-known name in the UK modified car insurance scene. They've been around for decades, they insure everything from lightly modified hot hatches to full-blown show cars, and they offer agreed value policies, which means you and the insurer agree upfront on the value of your car (including all modifications), and that's what you get paid out if it's written off. This is huge, because it means you're not left out of pocket if you've spent £10,000 on mods and the car gets totalled.

Brentacre Insurance is another major player, and they're particularly popular for performance cars and heavily modified builds. They're family-owned, they don't use call centres, and their staff genuinely know their stuff. Brentacre also offers like-for-like replacement cover, which means if you crash and your aftermarket exhaust is damaged, they'll replace it with another aftermarket exhaust, not a cheap standard one. Cosmetic modifications often don't even affect your premium with Brentacre, which is a massive plus.

Keith Michaels has been in the specialist insurance game for over 40 years, and they're trusted by a lot of the older heads in the scene. They're particularly good for classic and Japanese imports, and they offer bespoke policies tailored to exactly what you need. If you've got a modified Impreza, Evo, Skyline, or Supra, Keith Michaels should absolutely be on your list of brokers to call.

Performance Direct, Chris Knott, Greenlight Insurance, and A-Plan are also all solid options depending on your specific car and modifications. The key is to get quotes from at least three or four specialist brokers and compare not just the price, but the level of cover. Some policies look cheap until you realise they'll only pay out market value for a standard car, leaving you thousands out of pocket if your mods are expensive. For more on this, our guide to modifying cars safely has further advice.

What Happens If You Don't Declare Your Modifications (Spoiler: It's Really, Really Bad)

We've touched on this already, but it's so important that it deserves its own section with no ambiguity whatsoever. If you modify your car and don't tell your insurance company, and then you need to make a claim, your policy will be voided. Let's walk through exactly what that looks like in practice, because this is the nightmare scenario you absolutely have to avoid.

The Claim Investigation

You're involved in an accident. It's not your fault, or maybe it is — doesn't matter. You call your insurer to make a claim. They send out an assessor to inspect the damage. The assessor is not an idiot. They notice that your car is sitting two inches lower than it should be. They notice the aftermarket exhaust. They notice the wheels aren't standard. They notice the remap label in the service history. They take photos, they make notes, and they report back to the insurer.

The insurer then checks your policy documents and sees that you never declared any of these modifications. At this point, your claim is immediately flagged for further investigation. They'll request your full service history, they'll check your MOT records, they might even send someone to physically inspect the car more thoroughly. If they find undeclared mods — and they will — they invoke the "non-disclosure" clause in your policy, which states that you must inform them of any changes that affect the risk. You didn't. Your policy is void. The claim is rejected.

The Financial Fallout

You now have no insurance payout. If you were claiming for damage to your own car, you're paying for all the repairs yourself. If you caused damage to someone else's car, property, or person, you are personally liable for all costs. That could be £5,000 for a bumper repair on the other car. It could be £50,000 for serious injuries. It could be £200,000+ if you caused a multi-vehicle pile-up. And you have to pay it out of your own pocket, because your insurance won't cover a penny.

On top of that, your insurer reports you to the Insurance Fraud Bureau (IFB), and you're now flagged on the insurance industry's shared database as a fraud risk. Every insurer in the UK can see this. Getting insurance again is going to be incredibly difficult and expensive for years. You'll be forced onto specialist "high-risk" policies that cost two or three times what you were paying before.

And if you've been driving around uninsured (which you technically have been, because your undeclared mods voided your policy from the moment you made them), you could also face legal penalties: six penalty points on your licence, a fine of up to £5,000, and your car being impounded. It's a total disaster, and it all stems from trying to save a few quid by not declaring a £300 exhaust.

How to Actually Get the Best Deal on Modified Car Insurance

Right, so you've accepted that you need to declare everything, and you're ready to get properly insured. How do you get the best possible deal without getting ripped off? Here's the step-by-step approach that actually works.

Step One: Get Quotes Before You Modify

This is the smartest thing you can do, and almost nobody does it. Before you buy that exhaust, before you book in the remap, before you order the coilovers — call your insurer and ask them how much it'll cost to add that modification to your policy. Get a quote in writing. If the increase is acceptable, go ahead. If it's going to double your premium, you might want to reconsider the mod, or at least shop around for a different insurer first.

Step Two: Use a Specialist Broker

Don't waste your time with mainstream comparison sites. They won't give you accurate quotes for modified cars, and you'll end up frustrated. Go straight to the specialists — Adrian Flux, Brentacre, Keith Michaels, Performance Direct — and get quotes from all of them. Brokers have access to multiple underwriters, so they can shop around on your behalf and find the best deal. It's worth spending an hour on the phone to save hundreds of pounds.

Step Three: Be Honest and Detailed

When you're getting quotes, tell them everything. Every single modification, no matter how small. If you're not sure whether something counts, mention it anyway and let them decide. The more detail you give, the more accurate your quote will be, and the less chance there is of any nasty surprises later. Take photos of your car, keep receipts for all parts and labour, and be ready to send them over if the insurer asks.

Step Four: Consider Agreed Value and Like-for-Like Cover

If you've spent serious money on modifications, agreed value cover is worth every penny. It means that if your car is written off, you get the agreed value you and the insurer settled on at the start of the policy, not some lowball market value that doesn't account for your mods. Like-for-like replacement cover is also crucial — it ensures that if your aftermarket parts are damaged, they'll be replaced with equivalent aftermarket parts, not cheap standard ones.

Step Five: Add Security and Lower Your Mileage

Some modifications can actually lower your premium. Upgraded alarms, GPS trackers, steering wheel locks, and dashcams are all seen as reducing risk, and insurers will often discount your premium for having them. Similarly, if you're only driving limited miles (5,000 or fewer per year), you can get a significant discount by switching to a limited mileage policy. Every little helps.

Final Thoughts: Protect Your Investment, Protect Yourself

Modified car insurance isn't cheap, and it's not always fair. But it's absolutely non-negotiable. The cost of not being properly insured — financially, legally, and emotionally — is so much higher than the cost of doing it right. You've spent thousands building your car. You've invested time, effort, and passion into making it yours. The last thing you want is to lose all of that because you tried to cut corners on insurance.

Do it properly. Declare everything. Use a specialist broker. Get the right level of cover. And sleep easy knowing that if the worst happens, you're protected. Your future self will thank you.

For more advice on building and modifying cars the right way, check out our guides on the best value-for-money mods, UK modification laws, and how to avoid common modification mistakes.

Related Articles

Call to Action

Do you have a build story like this one? Got a build on a budget? We want to see it. Submit your story to Stance Auto Magazine, and you could be the next featured owner showing the world how to do it right—without breaking the bank.

And hey, don’t forget to tag us on socials. Use #stanceautomag on Instagram, Pinterest and Facebook so we can see (and maybe feature) your ride.

Test Your JDM Car Knowledge and Take Our No. 1 JDM Car Quiz

Order Your Stance Auto Car Magazines From Our Amazon Book Store

Test Your Automotive Knowledge and Take Our No. 1 Car Quiz

Get Noticed Use our Hashtags - #stanceauto #stanceautomag #stanceautomagazine #modifiedcarmagazine

UKTM no: UK00003572459

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png)

![[HOONIGAN] Ken Block's GYMKHANA NINE](https://img.youtube.com/vi/_bkX5VkZg8U/maxresdefault.jpg)

![[HOONIGAN] KEN BLOCK'S GYMKHANA SEVEN: WILD IN THE STREETS OF LOS ANGELES](https://cdn.motor1.com/images/mgl/2KlO4/s1/ken-block-london-tour-directors-cut.jpg)